reit dividend tax malaysia

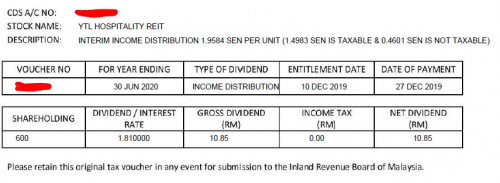

Prior to the announcement under the tax laws a property trust fund essentially an unit trust with income. As mentioned earlier a REIT company in Malaysia has to distribute at least 90 of its yearly income to enjoy tax exemption.

How To Invest In Malaysia Reits For Passive Income A Beginner S Guide

Trusts or Property Trusts REITPTF in Malaysia.

. Im new to this. Dividend withholding tax is how a country taxes the non-residents who have derived dividend income from the country. Its DPU shown in table was an annualised figure for the period between January and December.

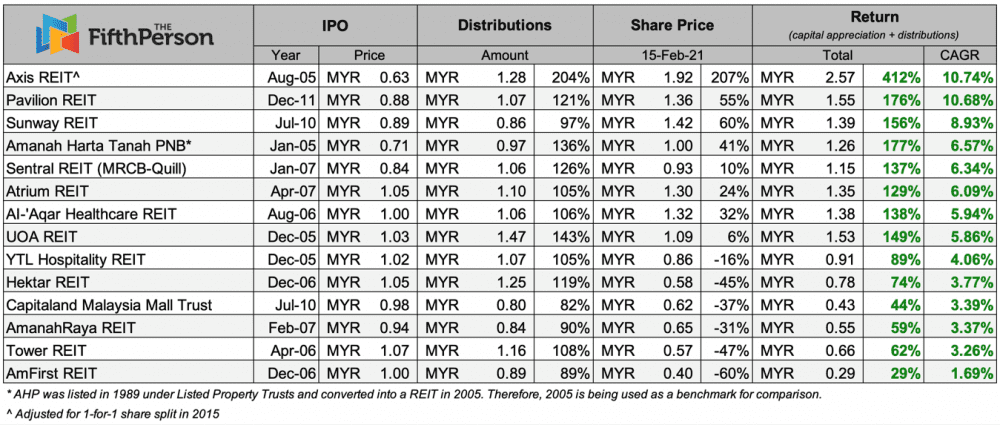

An A list of over 50 best dividend yield stocks in Malaysia with super actionable tips to help you get the best passive income for retirement from stocks. Axis REIT Annualised return. Including the dividends every RM1000 would.

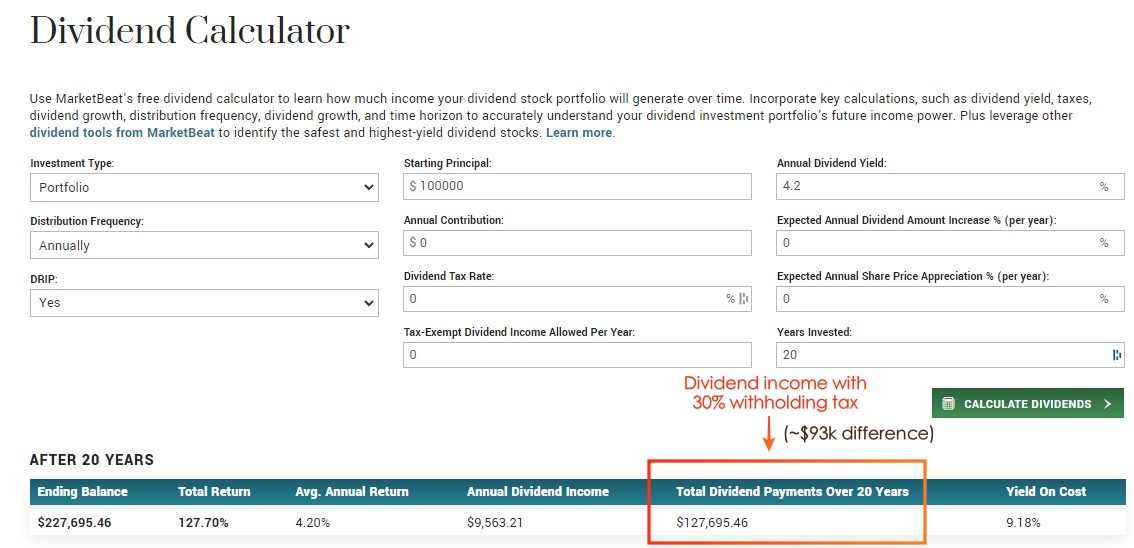

More than we can fit in this ad. Simply put the rental income received by the. When Malaysians invest in the US the dividends.

It may also earn income from fixed deposits or selling its real estate investments. For dividends categorized as ordinary income the rate at which you are taxed will vary based on your income and tax bracket. Listed REITs in Malaysia are exempted from annual tax assessment if they distribute 90 of the years total income to unitholders.

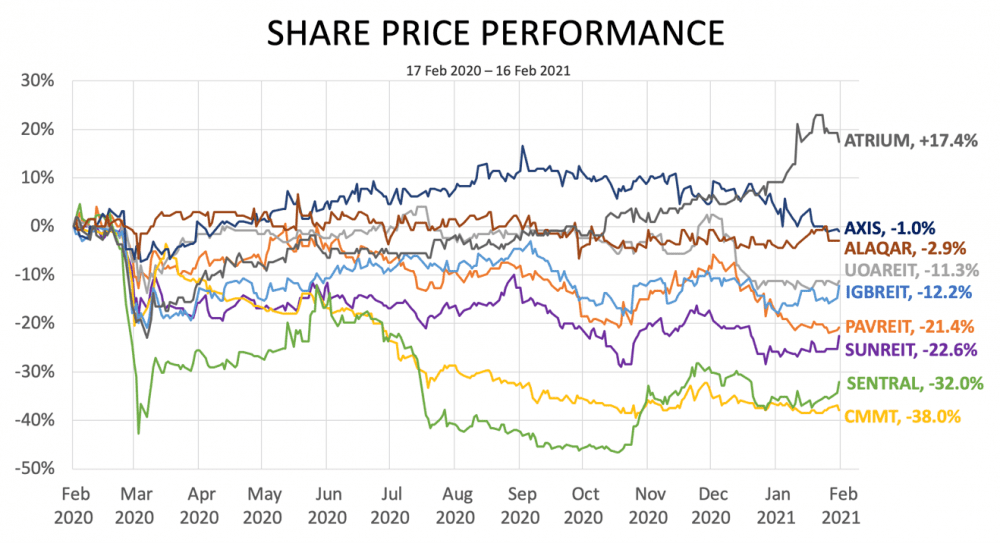

As a comparison neighbouring. Here are five reasons why you should invest in REITs in Malaysia. Governments announcement of remissions of dividend tax for the REIT sector under the 2007 2009 and 2011 budgets provide an excellent but rare opportunity to examine the impact of.

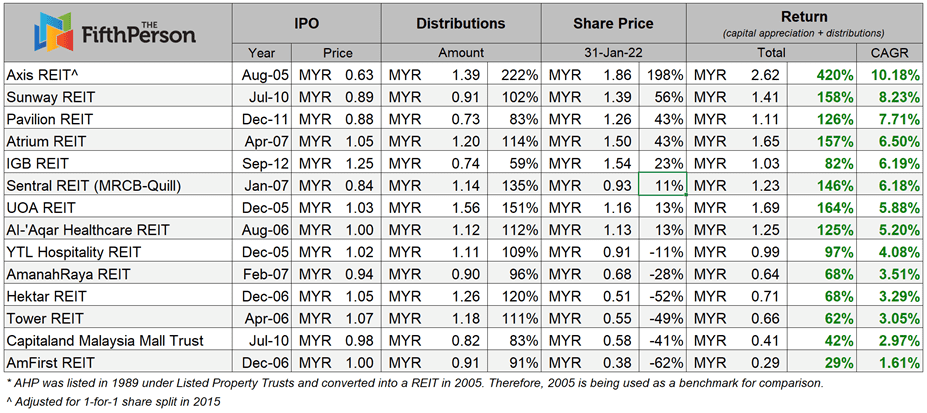

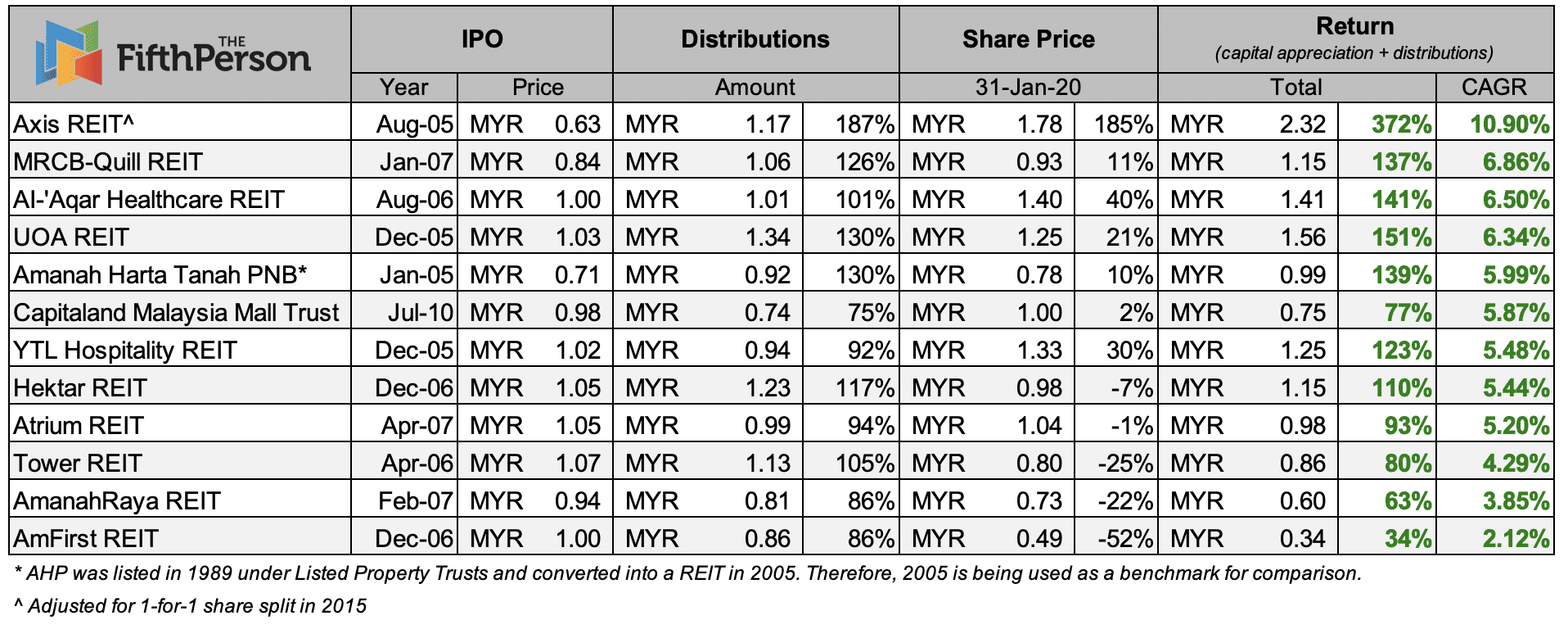

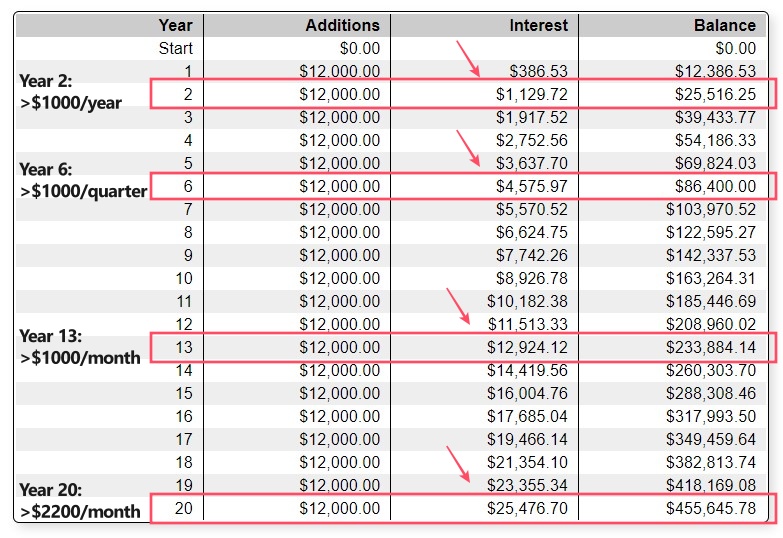

A REIT in Malaysia operates by pooling the. 1074 Since 2005 every RM1000 investment in Axis REIT wouldve turned into RM2980. Real estate investment trusts REITs are a unique form of investment designed to make money for you through the property industry.

Corporations making payments of the following types of income are required to withhold tax at the rates shown in the table below. Dividend income forms part. They are traded on stock exchanges and are eligible for special tax exemption.

HEKTAR REAL ESTATE INVESTMENT TRUST. Malaysian REIT Data LIVE Daily Updates. Since it was first introduced in Malaysia in 1989 REITs have allowed small-time investors to acquire and own a small portion of an otherwise expensive piece of real estate.

What makes C-REIT different than other top REITs. A REIT needs to pay tax on any taxable income earned during the year at a rate of 24 unless it distributes at. See Note 5 for other sources of income.

IGB Commercial REIT was listed in September 2021. For example if your taxable income was 50000. 19 rows Name Fullname Code Price PE ROE Payout ratio Gearing Ratio TTM DY Yield Link.

Ad Looking for a non-traded REIT. Build a private real estate portfolio with C-REIT.

How Are Individual Reit Holders Taxed

Finance Malaysia Blogspot Understanding Reits

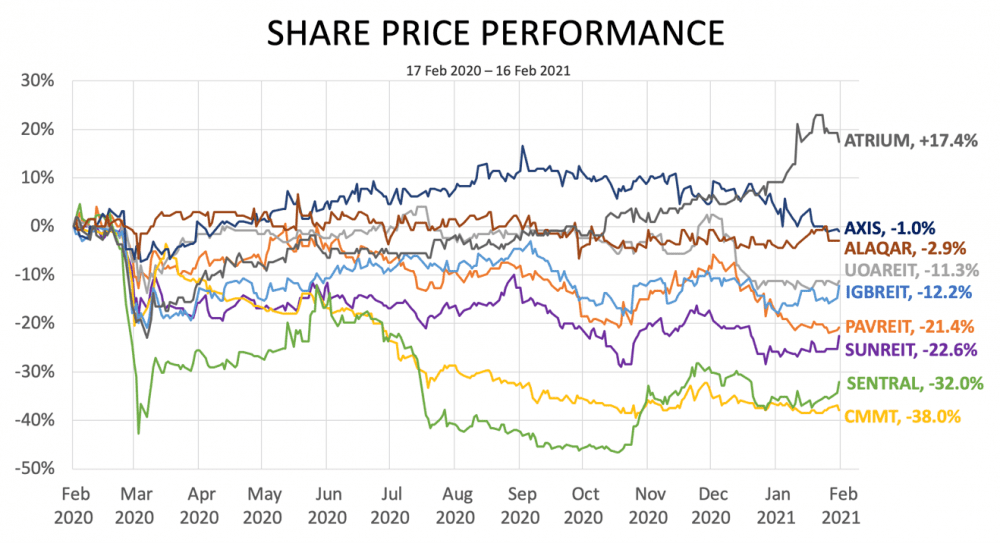

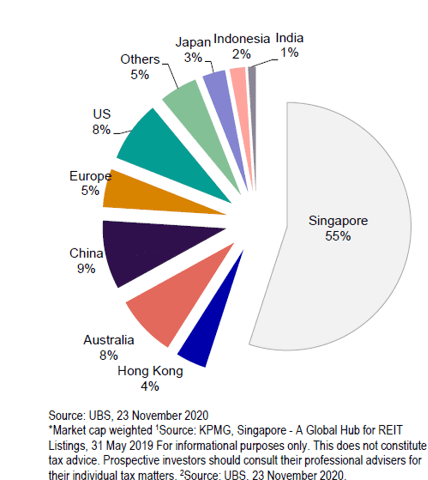

8 Things Every Investor Should Know About Asia Pacific Reits In 2021

Dividend Withholding Tax Rates By Country For 2021 Topforeignstocks Com

Investment Tips Strategies For Malaysians Dividend Magic

Top 5 Malaysia Reits That Made You Money If You Invested From Their Ipos Updated 2022

Top 5 Malaysian Reits That Made Money If You Invested From Their Ipos

5 Criteria I Use To Pick Outstanding Reit Marcus Keong

Summary Of Reits Stock Quote And Listed On Main Board Of Bursa Malaysia Download Table

Six Dividend Stocks That May Shine When Interest Rates Drop The Edge Markets

How To Invest In Malaysia Reits For Passive Income A Beginner S Guide

Sponsored All You Need To Know About Dividend Withholding Tax For Malaysians Stocks Etfs No Money Lah

Top 5 Malaysia Reits That Made You Money If You Invested From Their Ipos Updated 2021

How To Invest In Malaysia Reits Best Guide For Beginner Ringgit Insider

How To Invest In Malaysia Reits Best Guide For Beginner Ringgit Insider

Sponsored Post Guide How To Make 1 000 Month Passive Income From Dividends Via Reit No Money Lah

Multi Management Future Solutions Malaysia Tax On Reit Investment Malaysia Starting For The Year 2009 Tax For Reit Dividend Is As Follows Also Grab The Opportunity Of Free Analysis Report

How To Invest In Malaysia Reits For Passive Income A Beginner S Guide