what is the capital gains tax in florida

The Combined Rate accounts for the Federal capital gains rate the 38 percent Surtax on capital gains and the. Couples filing jointly pay 10 tax on the first 20550 of their income 12 on income from 20551 to 83550 and so on to a maximum of 37 for income 647850 and.

Capital Gains Tax What Is It When Do You Pay It

The State of Florida does not have an income tax for individuals and therefore no capital gains tax for individuals.

. Floridas capital gains tax rate depends upon your specific situation and defaults to federal rules. Generally speaking capital gains taxes are around 15 percent for US. Taxes capital gains as income and the rate reaches a maximum of 985.

The rate you receive will depending on your total. You may obtain a couple of exceptions to the long-term capital gains tax rule. The Florida income tax code piggybacks the federal income tax code for treatment of capital gains of corporations.

Florida does not have state or local capital gains taxes. Capital Gains Tax Exemption When selling your house in Florida you can exclude a high portion of your profits given specific conditions are met. The Combined Rate accounts for the Federal capital gains rate the 38 percent Surtax on capital gains and the.

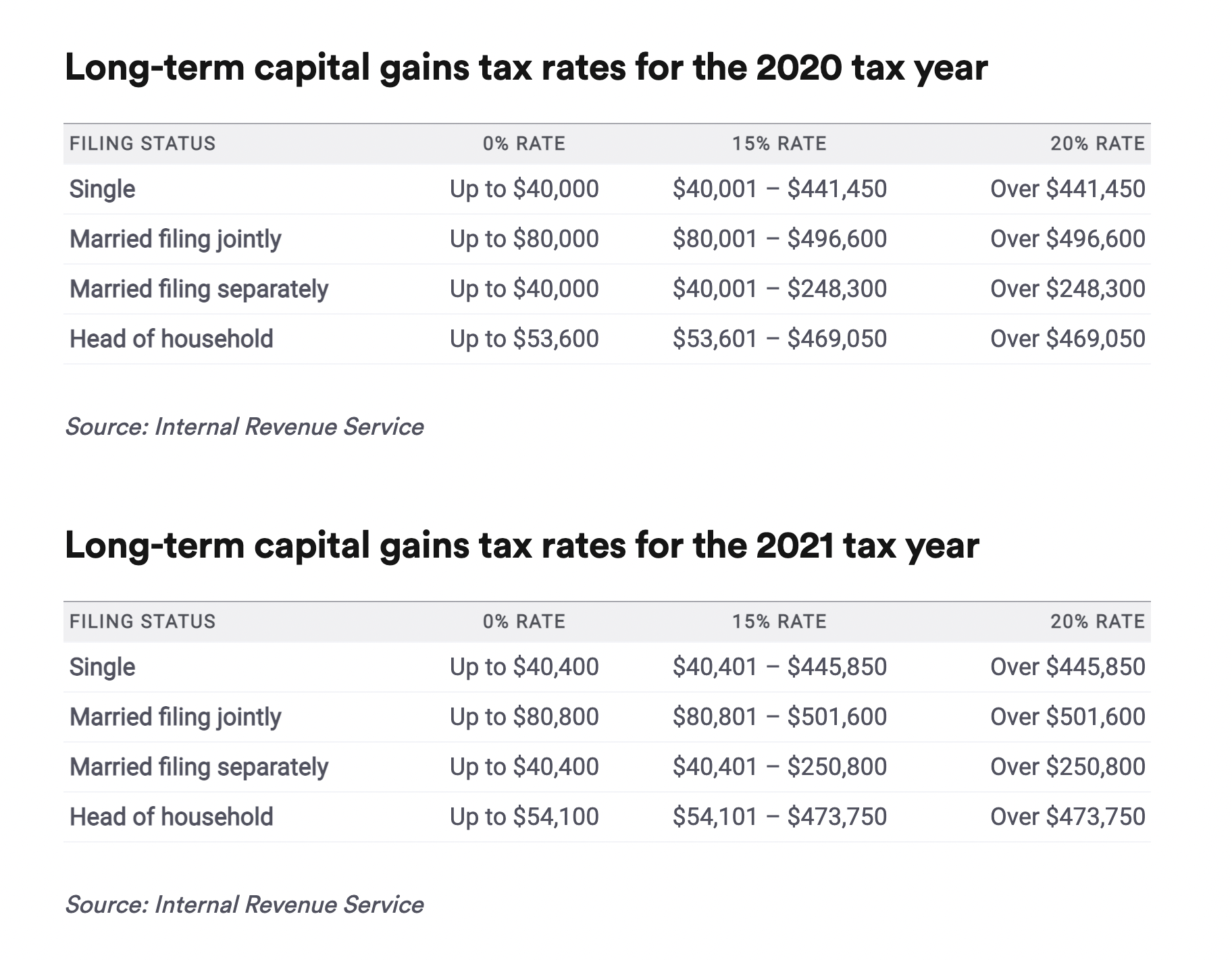

4 rows There is no Florida capital gains tax but you still have to pay federal taxes if you sell. The capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. Depending on your regular income tax bracket your tax rate for long-term capital gains could be as low as 0.

The first and most important thing to. Even taxpayers in the top income tax bracket pay long-term capital gains rates. Therefore youll have to pay capital gains from.

Florida does not assess a state income tax and as such does not assess a state capital gains tax. Generally speaking capital gains taxes are around 15 percent. Florida Capital Gains Tax.

Any money earned from investments will be. During this time the value of the property increased by 100000. Capital gains taxes on assets held for a year or less correspond to ordinary income tax brackets.

Florida Capital Gains Taxes. There is no Florida capital gains tax on individuals at the state level. Residents living in the state of Florida though there are those who can see a long-term capital gains tax rate as high as.

If you earn money from investments youll still be subject to the federal capital. Individuals and families must pay the following capital gains taxes. Residents living in the state of Florida though there are those who can see a long-term capital gains tax.

Ncome up to 40400. What is the capital gain tax for 2020. Generally speaking capital gains taxes are around 15 percent for US.

You have lived in the home as your. When a seller sells a business in Orlando or any other area Capital Gains taxes are applied to the actual profit made upon the sale of the business and not the equity that was put. Federal long-term capital gain rates depend on your income tax bracket - the highest rate for US.

Capital Gains Tax Rate Currently Floridas business tax rate is 55 percent with exemptions for passthrough entities. Florida does not have state or local capital gains taxes. Exceptions To The Long-term Capital Gains Tax Rule.

The State of Florida does not have an income tax for. Not All Profits Are Taxable. Since 1997 up to 250000 in capital gains 500000 for a married couple on the sale of a home are exempt from taxation if you meet the following criteria.

Florida has no state income tax which means there is also no capital gains tax at the state level. For example you inherited a house worth 500000 and kept it for 5 years. If your taxable income is less than 80000 some or all of your net gain may even be.

New Jersey taxes capital gains as income and the rate reaches 1075.

Capital Gains Taxes Are Going Up Tax Policy Center

Capital Gains Tax Calculator Estimate What You Ll Owe

State Taxes On Capital Gains Center On Budget And Policy Priorities

What Are Long And Short Term Capital Gains Personal Capital

Irs How Much Income You Can Have For 0 Capital Gains Taxes In 2023

How High Are Capital Gains Taxes In Your State Tax Foundation

Tax Implications Of Canadian Investment In A Florida Rental Property

2022 Real Estate Capital Gains Calculator Internal Revenue Code Simplified

Crypto Tax 2021 A Complete Us Guide Coindesk

State Taxes On Capital Gains Center On Budget And Policy Priorities

Selling Property In Florida As A Non Resident

Article What Is The Capital Gain Tax What Is The Capital Gain Tax

Florida Qualified Small Business Stock Qsbs And Investor Tax Incentives Qsbs Expert

Florida Capital Gains Taxes What You Need To Know 2022 Michael Ryan Money

Short Term And Long Term Capital Gains Tax Rates By Income

Indexing Capital Gains Basis For Inflation Florida Chamber Of Commerce